2023 Private Capital Activity in Africa

This report provides analysis on the latest trends of fundraising, investments, and exits within African Private Capital Activity in Africa, shedding light on the recent developments that took place during 2023.

If you have any questions or comments, please don't hesitate to reach out to research@avca-africa.org

Read the public report

2023 African Private Captial Activity ReportKey Facts:

- 450 reported deals in 2023, marking Africa’s sharpest decline in investment volume since 2012

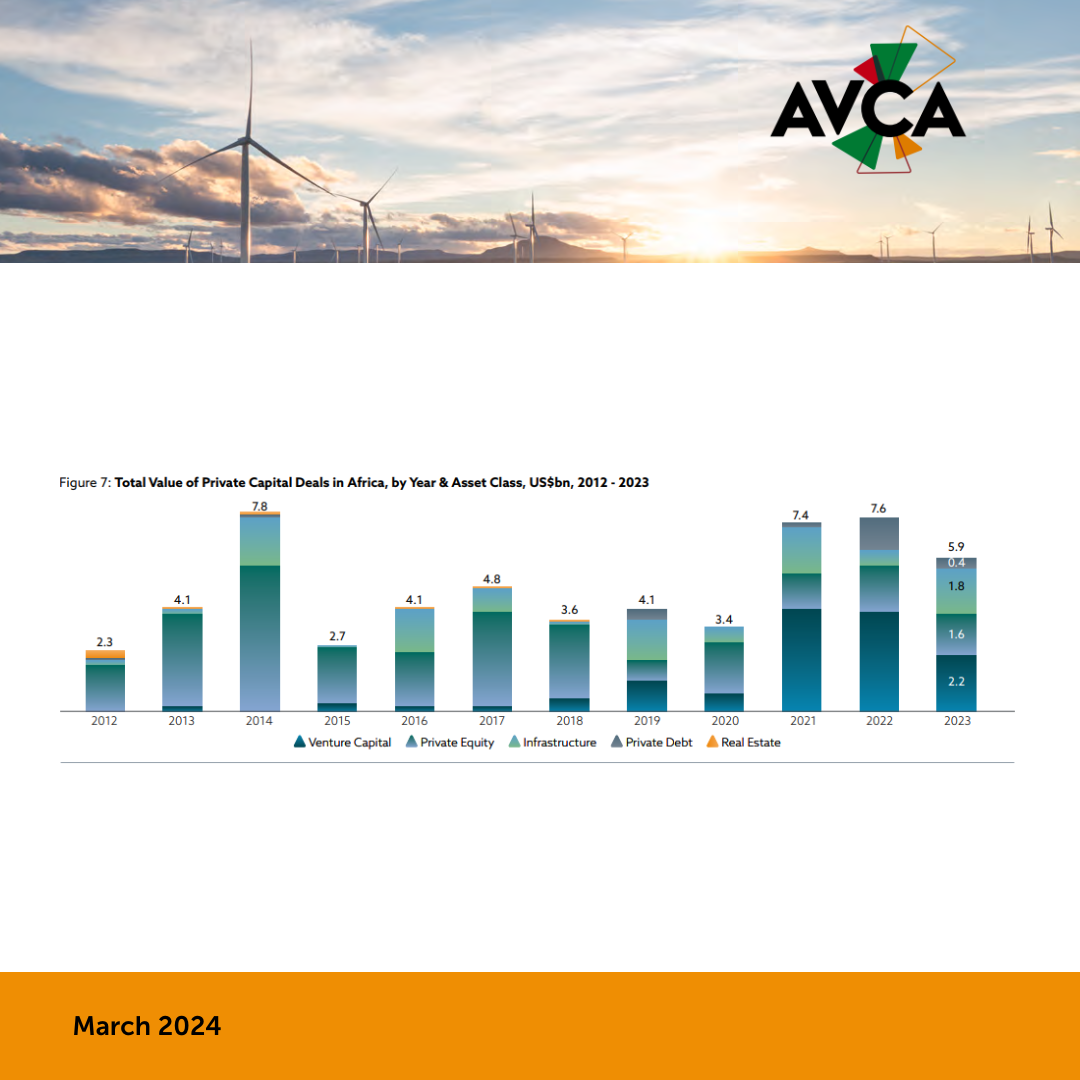

- US$5.9bn total deal value recorded in 2023, down 22% year-over-year (YoY)

- 43 Private Capital exits were reported in Africa, a significant 48% YoY decline

- US$1.9bn was the total value of final closed funds in Africa in 2023, a modest decrease of 9% YoY

- Africa focused fund managers achieved 40 interim closes with a combined value of US$3.0bn, the highest interim fundraising volume and value on record

- First-time fund managers secured US$0.7bn in final closed funds, representing 35% of the year’s total commitments, a 107% YoY increase from 2022

Download Infographics & Share Key Insights From The Report With Your Network

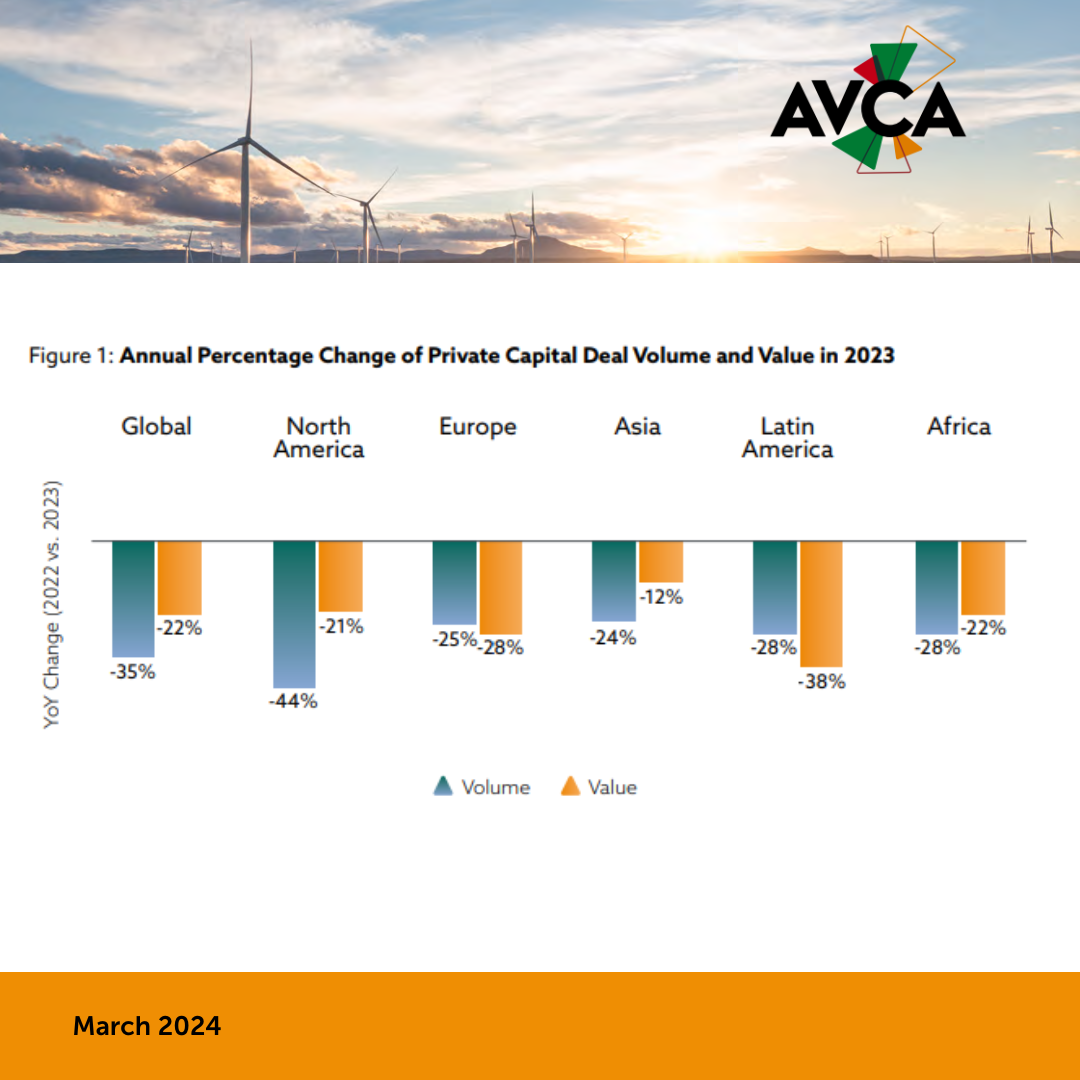

🌍 Private Capital Dealmaking Activity: A Global Comparison

In 2023, the global economic landscape remained turbulent with geopolitical turmoil, trade imbalances, and rising interest rates. Despite a faster-than-anticipated decrease in inflation by year-end, interest rates continued to soar. This challenging environment led to a 35% decrease in global private capital investment activity, with North America and Latin America experiencing significant drops of 44% and 28% in deal volume respectively.

Africa wasn't spared either and witnessed its steepest decline in 12 years.

Download the full report for more insights: https://bit.ly/3xja4gT

#GlobalEconomy #PrivateCapital #EconomicTrends2023

🌍 #VentureCapital: Africa's Leading Asset Class

As 2023 unfolded, Africa faced a notable slowdown in its private capital activity. The downturn was predominantly driven by a slump in venture capital investments, despite it remaining the top investment asset class with 68% of deal volumes and 38% of deal values.

Download the full report for more insights: https://bit.ly/3xja4gT

#PrivateCapital #AfricaInvestment #2023Review

📈 Infrastructure fuelled by renewables is having a moment in 2023

Despite a decline, 2023 saw Africa's private capital investments hit the fourth-highest value since 2012.

This growth was primarily driven by two large infrastructure investments, both in the renewable energy sector in South Africa; reflecting increasing commitment to Africa's clean energy transition

Download the full report for more insights: https://bit.ly/3xja4gT

#PrivateCapital #AfricanInvestment #RenewableEnergy #InvestmentTrend

🌍 Southern Africa named the most resilient region on the continent

Accounting for 26% of the overall deal volume and 44% of the overall deal value, Southern Africa stands as a dominant force in Africa's private capital landscape, driven by South Africa’s renewable sector.

Download the full report for more insights: https://bit.ly/3xja4gT

🌍 2023 marked a historic year for First-time fund managers in Africa, despite preference for Experienced Fund Managers

First-time fund managers secured a 35% share of final closed values in 2023 - a remarkable 2.1x YoY increase and the highest since 2019.

A standout achievement was the US$205mn final closing of the Norrsken22 African Tech Growth Fund in November 2023, ranking as the third largest close of the year and the second largest by a First-time manager between 2018-2023.

Download the full report for more insights: https://bit.ly/3xja4gT

#FirstTimeFundManagers #InvestmentTrends2023

✨ Africa-focused fund managers the highest interim fundraising volume and value on record

The latest report by AVCA showed that in 2023, Africa-focused fund managers showcased remarkable resilience with 40 interim closes, amassing a combined value of US$3bn - the highest volume and value of interim fundraising on record.

Download the full report for more insights: https://bit.ly/3xja4gT

#AfricanPrivateCapital #Resilience #FundraisingTrends